Silicon News: Austin is Becoming a Hub of Innovation for the Insurance Industry

Data analysis, machine learning and artificial intelligence are driving big changes in the insurance industry. Read more…….

Data analysis, machine learning and artificial intelligence are driving big changes in the insurance industry. Read more…….

Since inception, our vision for plnar has been centered on the very human elements of technology, and how artificial intelligence and augmented reality can help us work smarter, better and faster. We think we are pretty good at doing that, and a lot of people seem to agree. Our original AR dimensioning app has been downloaded more than 400,000 times since its launch in 2017 and has helped users complete thousands of projects.

Two years can be eons in technology startup time, and we have never stopped learning and growing since we launched the app. We have talked to countless organizations across the insurance industry and realized there were significant challenges and gaps to implementing virtual claims that we were perfectly suited to solve. Additionally, we brought on insurance executive and industry strategist Andrew Robinson to our Board of Directors in March, and his expertise has been an invaluable asset to our deepened understanding of the insurance industry. The more we dove in, the more we realized that we could offer something powerful, unique and essential to insurance companies—the ability to completely digitize and provide the completed context of interior properties and damages – a key requirement needed to make their dreams of virtual claims a reality.

Virtual claims are vital to the continued life and growth of insurance companies, especially because so many technology disrupters have made huge gains in what was once a conservative industry dominated by legacy leaders. Customers have more choice than ever, and extreme generational differences in service options can make insurers feel like it’s impossible to make everyone happy. Not to mention, operating costs continue to skyrocket with no signs of slowing down.

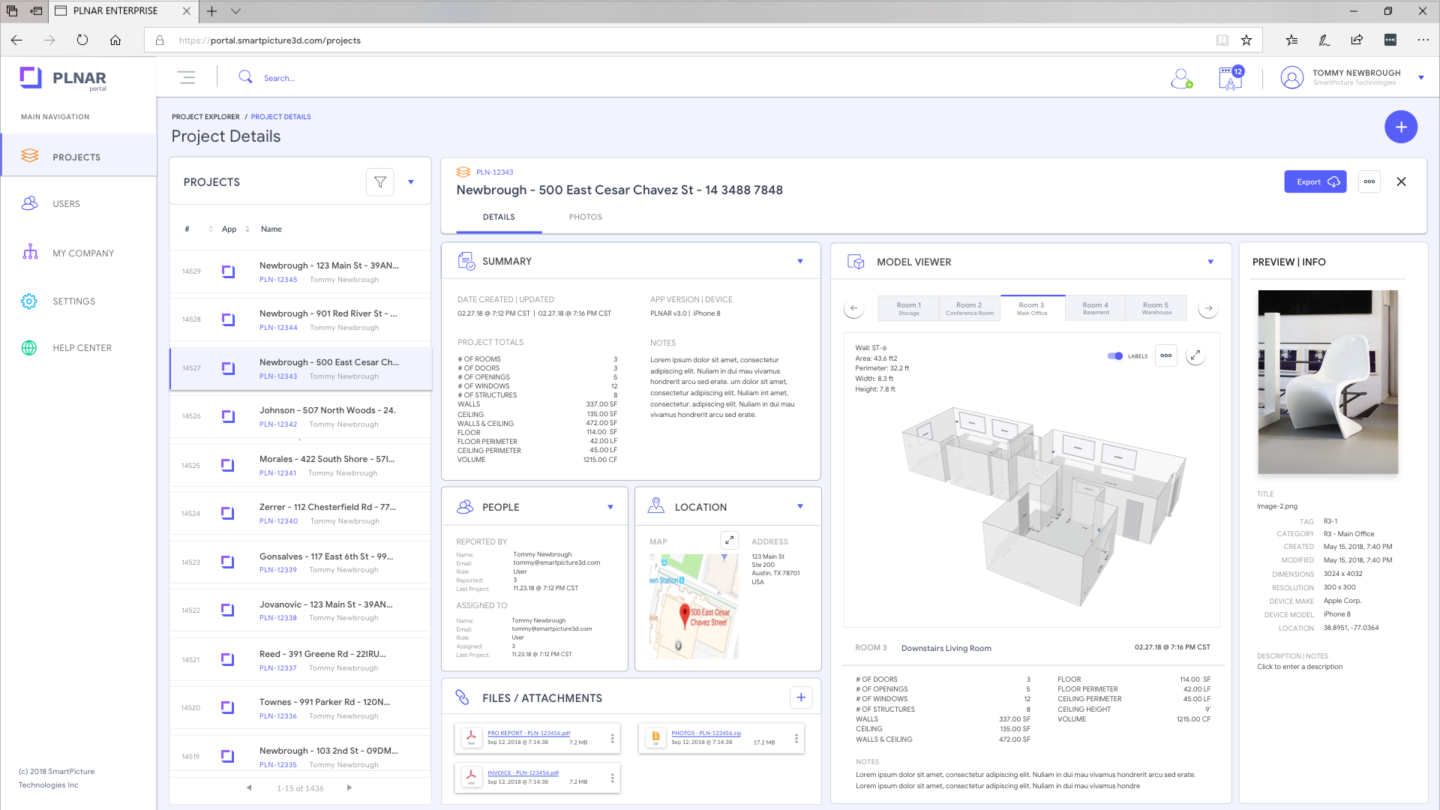

This is where plnar comes in. Our research, deep learning, technology expertise and development and strong leadership have culminated in our digital desk platform for interior property claims that enables digital desk adjusting and the self-service experience that consumers expect. They say the best things in life come in threes, and our digital desk adjustment platform enables self-service claims with a digital smartphone, generates complete data sets, including interactive 3D models, and puts the desk adjuster virtually in interior spaces with digital desk tools. This three-step approach helps insurance companies digitize their adjustment processes to deliver fully virtual claims and delight customers across the board.

The “secret sauce” to our digital desk platform is SmartPix, a first-of-its-kind dimensioning and modeling technology. We have recently announced a new version of this technology that puts desk adjusters virtually in interior spaces and allows the addition of in-photo measurements and up-to-date 3D models without time-consuming, expensive, back-and-forth exchanges with field resources. By enabling digital desk adjustment with SmartPix, plnar allows adjusters to work faster by seeing the full context of an interior without ever leaving their desk.

This renewed vision and reinvigorated focus on bringing truly virtual claims to interior properties by enabling a digital desk platform for insurance companies is a natural evolution of our mission. At plnar, we do not avoid change if all our data, insight and learning tells us that change is needed for true innovation. After all, Winston Churchill once asserted that “to improve is to change; to be perfect is to change often.”

We are excited to enable virtual claims for interior properties with our digital desk platform because we know it is an essential step forward in making the insurance claims process better for insurance companies and their customers alike. Our promise to our clients (and Winston Churchill) is this—we will never stop pursuing perfection.

Sincerely,

Andy Greff

The landscape of the insurance industry continues to evolve with emerging technologies, and that rate of progression is accelerating. Companies still hanging on to legacy practices are not only falling behind, they’re in danger of becoming completely obsolete.

Becoming a dynamic “intelligent enterprise” means setting a precedence for workforce empowerment AND customer experience via innovative digital solutions. In January of 2019, Accenture reported 90% of insurance executives now have a coherent, long-term plan for technology in place. More than 60% report that technology is already having a significant impact on their claims and underwriting processes. This transformation is paramount to increasing the strength and influence an organization has on the market. Not only do you have some of the largest organizations creating substantial competition, vying for top position, but this digital disruption created a slew of newcomers. These companies offer an abundance of innovative digital products and services proving to have tremendous influence.

For instance, take these three companies that are changing the very nature of insurance; and demonstrating what it means to provide empowerment through increased efficiency, agility, and transparency:

Tech startup Hippo cites itself as “a fresh approach to the home insurance market, which has seen little innovation in over half a century.” Hippo has a fixed focused on exemplary customer experience. It uses AI in a variety of ways, from gathering and utilizing agile personal and market data insights, to aerial imagery assessments for damage updates and/or predictions, all to provide an experience truly new and unique to the market.

Cystellar, a cloud-based big data analytics platform provides real time geospatial insights for live catastrophe and continued risk monitoring. Pulling data from satellite imagery, the (Internet of Things), and drone-based surveillance, the platform enables predictive analytics. They’ve made a huge impact with their primary data focus on helping insurers and their clients avoid damaging events, especially in the colossal agricultural and food sectors.

Finally, PLNAR offers the only interior virtual claims solution for comprehensive data collection designed for insurance. It utilizes an Augmented Reality app and cloud-based reporting for Claims Adjusters to fully scope a claim in less than half the time. Measurements, photos, annotations (scope notes), and 2D & 3D floor plan models are packaged in a customized report in just minutes. With real time reporting to carriers, customer satisfaction is improved by offering a higher level of transparency and service.

“The operational efficiencies you can capture by applying technology to the middle and back office are a huge, real-time measurable benefit.” – Greg Baxter, MetLife

The key staples of disruptive products and services are agility, proactivity, responsibility, transparency, and relevancy. So how does a legacy insurance organization begin to pivot? It starts with a rapid re-prioritization of organizational focus and assets, a deliberate evaluation of products and services to implement, and a willingness to collaborate with advanced technology business partners.

In my next blog post, I’ll discuss the impact that AR/VR is having on the insurance industry. For further information on the previously mentioned disruptors, click the links below.

Hippo www.myhippo.com | Cystellar www.cystellar.com | PLNAR www.plnar.ai