AUSTIN, TX, USA, March 11, 2021 /EINPresswire.com/ — Plnar, the innovative InsurTech AR/AI-enabled software provider, today announced it has joined the CoreLogic® Digital Hub Alliance™ to deliver another milestone in its mission to transform interior property claims. Plnar makes virtual, contactless insurance resolution a reality with complete data capture and delivery of virtual claims through a seamless integration with the CoreLogic Digital Hub Alliance.

Now insurance adjusters will have an even greater ability to gather data from policyholders with measure-ready photos and 3D models, write estimates and settle claims – all virtually.

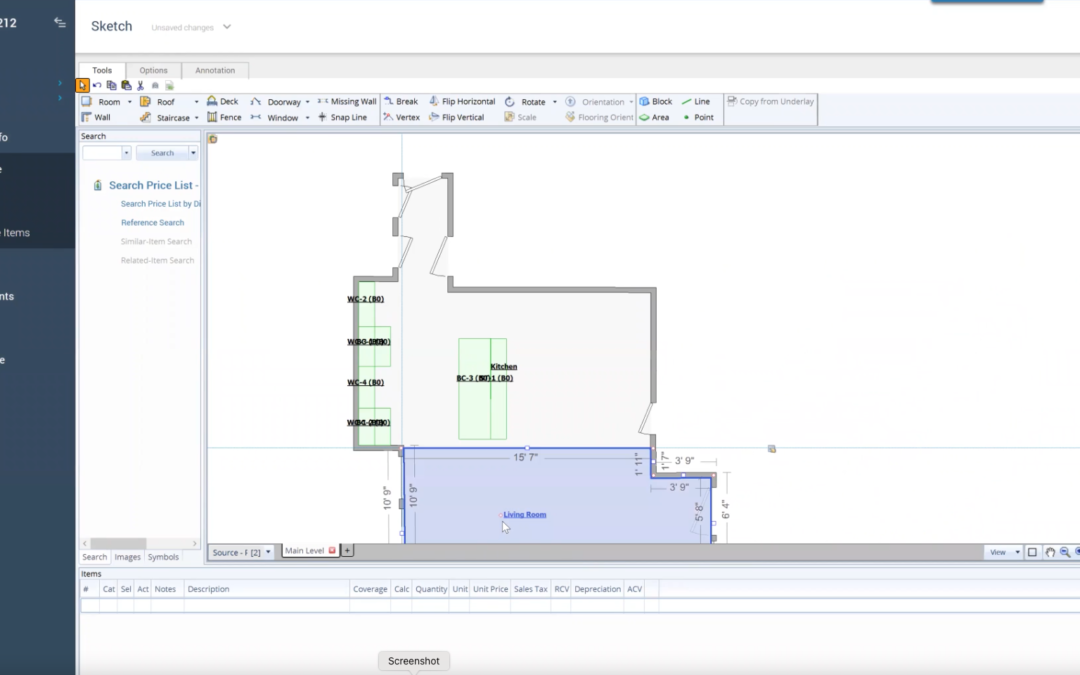

Plnar first created their Contactless Interior Claims solution, Plnar Snap, to put the power in the hands of policyholders and on-site inspectors as well as provide a virtual adjustment of interior property claims. The CoreLogic Digital Hub Alliance implements a future-proof digital strategy to enable clients to take advantage of the latest InsurTech advancements–including Plnar’s Contactless Interior Claims solution.

“The CoreLogic Digital Hub Alliance provides an easy way to seamlessly integrate Plnar technology within CoreLogic workflow platforms,” said Andy Greff, CEO of Plnar. “Designed to work easily with one another, this integration helps to make the interior claims process easier, faster and more efficient for everyone involved.”

Coming at a time when safety continues to be a paramount concern worldwide, a virtual and contactless claims adjustment process is more important than ever. This timely technology integration through the CoreLogic Digital Hub Alliance will serve to protect people from unnecessary contact and unwarranted delays while reporting and processing property insurance claims.

Insurers typically use a variety of resources to document claims, often resulting in inconsistent photos, missing data and other documentation discrepancies. With Plnar, through the CoreLogic Digital Hub Alliance, customers now get a standardized photo capture and documentation process for policyholders and onsite adjusters. Plnar guides policyholders or adjusters through the same easy-to-follow steps and standardizes measurement data ensuring desk adjusters have access to the right photos, context and data for interior property claims every time.

For insurance carriers, the benefits of Plnar joining the CoreLogic Digital Hub Alliance are threefold: efficiency gains for field adjusters, new ways to inspect interior losses, and the possibilities of underwriting inspections of the interior of homes to understand risk – rather than relying only on exterior inspections. Putting Plnar in the hands of a consumer, an agent, an underwriting inspector, a contractor or even a drone pilot provides insurers and policyholders the flexibility of who can conduct interior loss inspections, all with the same accurate result.

“With the integration of Plnar through the CoreLogic Digital Hub Alliance, we will be able to tap into precise interior property data, context, 3D models and measurements for interior property claims,” said John Langowski, Chief Claims Officer and EVP of Swyfft. “The integration will allow us to identify a variety of resources and collaborations that enhance the customer experience and the efficiency of the adjuster involved in resolving the claim.”

No retraining or workflow changes will be needed: Plnar drops easily into the carrier’s current processes. That means there’s no need to log in to another system or rekey the claim information. The CoreLogic Digital Hub Alliance allows plug-and-play access to the claims workflow straight from the Plnar assignment.

For policyholders, Plnar joining the CoreLogic Digital Hub Alliance removes the need to make appointments or wait for inspectors. People can get their claims started by simply downloading an app and following simple instructions. Every photo they take with Plnar Snap is embedded with dimensioning data, so carriers no longer have to send anyone on-site.

“Through the Digital Hub Alliance, CoreLogic is delivering greater choice, flexibility and performance to clients through the latest InsurTech offerings — enabling members like Plnar to provide contactless inspection technology with the flip of a switch,” said Rose Hancock, principal, technical product consultation at CoreLogic. “Plnar joins other members to enable best-in-class efficiency and customer experience across the claims management platform, all while accelerating claims resolutions.”

For more info or to see a demo, visit https://plnar.ai/request-demo/

***

ABOUT Plnar

Plnar is an InsurTech software provider transforming the insurance claims process by enabling contactless inspections for interior property claims for significantly better customer experiences, shorter cycle times and lower costs. Plnar’s patented technology platform gives desk adjusters the power to generate fully realized 2D and 3D models of interior spaces from digital photos and streamline the claims process for quicker, more efficient settlement. For more information, please visit the Plnar website at https://PLNAR.ai/

ABOUT CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.