Over the last year, we’ve seen firsthand the impact our cost-saving, process-streamlining, policyholder-pleasing platform has had on insurance carrier bottom lines and claimant happiness. In this four-part blog series, we share the real power plnar has to help insurance carriers and policyholders alike respond to catastrophes, triage, re-inspections and building better virtual claims. In part 2 of this series, we are exploring how our platform helps carriers deploy inspector and field adjuster resources more efficiently and cut costs with virtual, self-service claims that policyholders will love.

Property insurance is a necessity that most people hope they will never need to use—it provides peace of mind, however, when the inevitable happens. Each year, about one in 20 insured homeowners will need to file a claim, and one out of 50 claims will be because of unavoidable damage from natural events. When these events happen, the insurance claim process should not add complex, inefficient and expensive factors that burden carriers and delay pay-out to the policyholder.

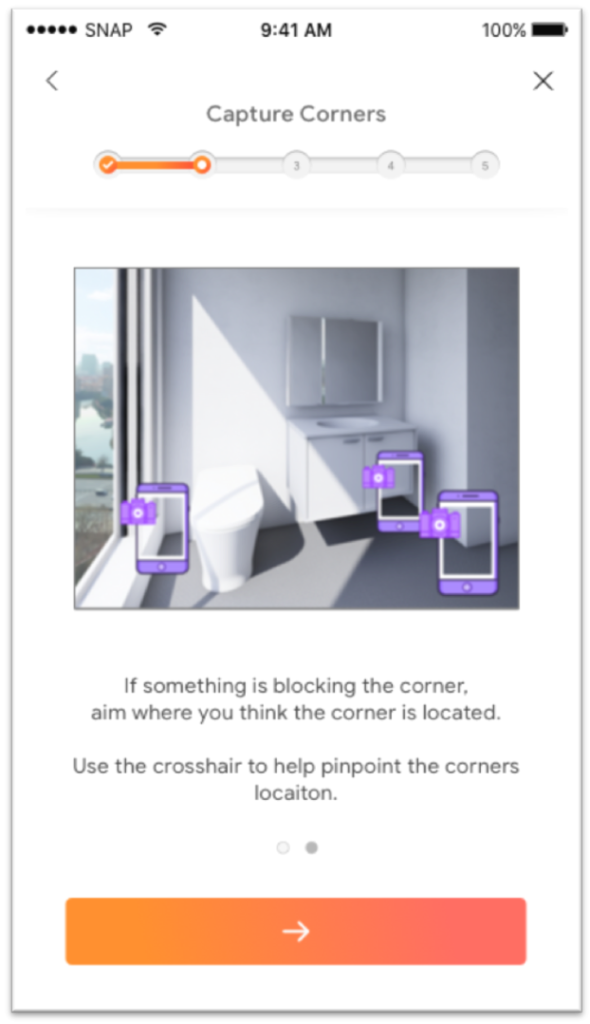

Meeting changing customer expectations for user experience is just one benefit. plnar helps reduce costly and unnecessary overhead for carriers by allowing the homeowner to capture interior property data in the plnar SNAP app, eliminating the need to deploy field adjusters or inspectors for simpler claims. What once would require scheduling an onsite inspection, which could take days or weeks, can now be conveniently snapped with a policyholder’s phone and submitted via the plnar SNAP app.

Carriers dealing with overbooked field adjusters, missing or incorrect information, ineffective communication, inconsistent data, and long waiting periods must rethink their approach, or risk losing business. 40% of policyholders now expect virtual self-service claims, and carriers who can offer this option will be attractive enough to make many of them switch. plnar helps carriers meet this growing demand for self-service by bringing the interior property claims process into a mobile, digital landscape.

Common types of claims that do not require an onsite inspection or adjuster include:

- Water damage from wind-driven storms

- Pipe burst / sudden water discharge

- Water leak from appliances

- Sewer backup

- Low severity of smoke damage

- Low severity of electrical fire damage

- Ceiling damage from a leaking roof

- Vandalism

Field and desk adjusters are still a valuable part of the insurance business, but with plnar, their time is better focused on complex claims that need onsite inspectors, data analysis and estimation. This is particularly helpful in markets with limited agents. Insufficient resources often cause agents to work with incorrect data or information, causing readjustments of claims–which can double the cost. And that is no small amount of money as the average cost per claim for an adjuster’s visit is $300, sometimes up to $600.

By enabling carriers to outsource much of this process to homeowners, our platform can reduce overall claim costs by up to 70%.

plnar also speeds up the claims resolution timeline from start to finish. On average, it takes 14 days to resolve a claim; however, with plnar, the claim can start the minute the homeowner begins the process in the app, saving days in the claims’ cycle.

plnar is paving the way for insurance to seamlessly offer opportunities for increased customer engagement and happiness while meeting their needs more efficiently. We also help carriers cut down on avoidable and unessential costs and can save days in the claim process. These savings ultimately benefit both the carrier and policyholder by providing faster, more consistent, data, productive communication and cut down on the need for re-inspections.

Did you miss part 1 in our Building the Business Case for Plnar series? Click here to read about how our platform can transform catastrophe response from reactive to proactive.