In all the time the plnar team has been working together perfecting the components of our platform, we’ve known we built something truly great. The last year, however, has demonstrated to us more than ever the impact our cost-saving, process-streamlining, policyholder-pleasing has when it matters most. In this four-part blog series, our team reveals the real power plnar has to help insurance carriers and policyholders alike respond to catastrophes, triage, re-inspections and building better virtual claims. In part 1 of this series, we will be diving into how plnar helps carriers proactively respond to the onslaught of claims associated with catastrophic events.

Catastrophes are stressful for everyone on a purely emotional level; layer on the logistical nightmare they create while racking up a huge bill for insurers, and they are a recipe for chaos, frustration, and process breakdown. The emotional price tag associated with these events also has a monetary price tag.

As hurricane destruction from three storms ravaged already vulnerable areas, additional flooding, tornadoes and drought-fueled wildfires cost the United States a record-breaking $306 billion last year. Of that $306 billion, insurers covered $90 billion, about 40% of the total damage costs. Experts cite shifting socioeconomics and population density in vulnerable areas as well as changing climate patterns as the main drivers of these increasing costs.

As the costs continue to rise for insurers, they also continue to rise for the people directly affected by catastrophic events. Increasing premiums, backlogs of unresolved claims, and gaps in coverage due to spotty documentation plague policyholders who are already facing a long, slow recovery and rebuild process.

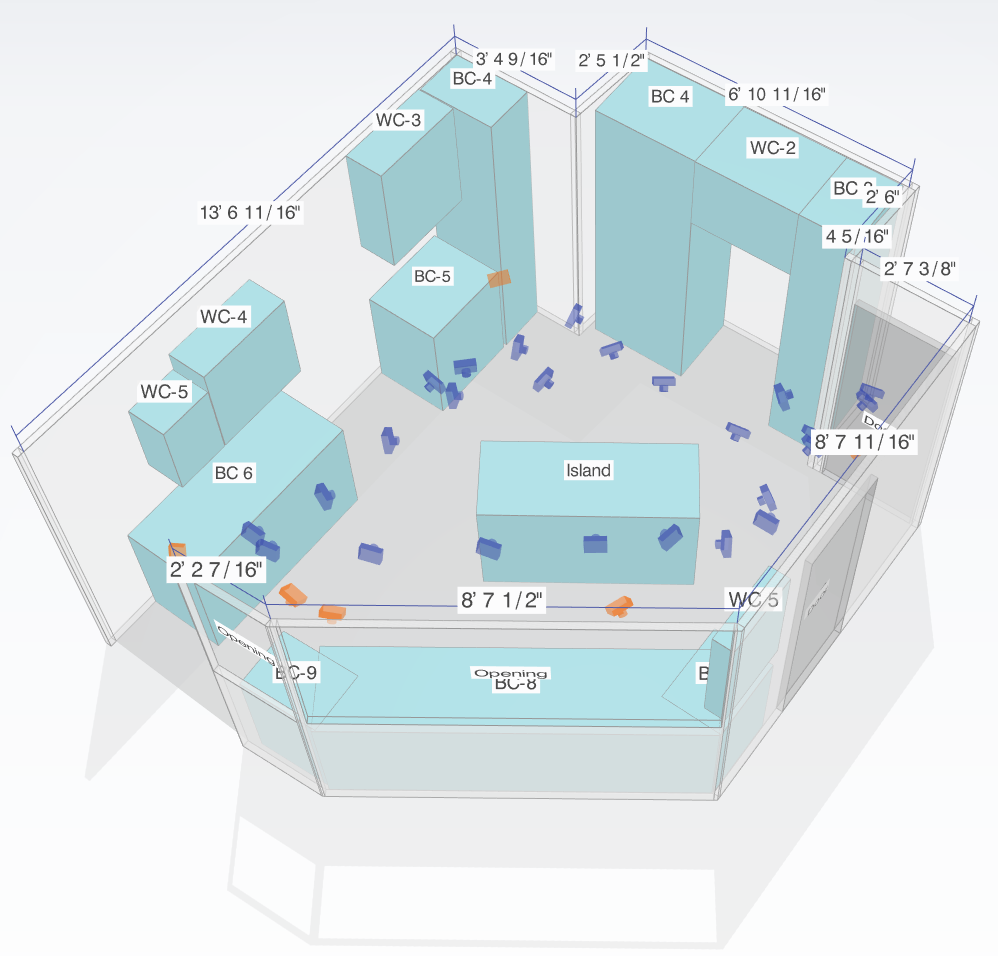

While not all catastrophes are predictable, some, like hurricanes or spreading wildfires, have windows of time where carriers can interact with policyholders and put proactive measures in place before disaster strikes. With the plnar platform, carriers can send policyholders notifications through the plnar SNAP app to take safety precautions and prompt users to record new or updated documentation about their home and belongings. Later, if the policyholder’s home is affected, this information can be used to start a claim without needing to deploy an on-site adjuster. If there is additional damage to document when the policyholder returns home, they can do so through the same plnar SNAP app without needing to call an on-site adjuster. This enables carriers to pay out portions of a claim even before the policyholder returns home after evacuation, and reduces adjuster backlogs and long wait times for policyholders.

The plnar digital desk adjustment platform provides policyholders with peace of mind by making it easier for insurance adjusters to start catastrophe claims before the event happens, while also utilizing simple, actionable alerts through the plnar SNAP app.

Getting claims dollars into the hands of policyholders faster speeds along the recovery and rebuild process by giving them the chance to hire contractors faster, get reimbursed for lodging, and stay safely away from their home while taking care of business.

Most importantly, the policyholder has accurate 3D models of their home, pre-damage, to help designers and contractors make their home look as good as new as fast as possible.

By enabling proactive, responsive communication and simple, fast property data collection through the plnar digital desk adjustment platform, carriers can provide a better customer experience while reducing costs and speeding up the claims process.

Catastrophes put an intense demand on adjustment resources for carriers, and plnar alleviates this pressure by empowering policyholders and reducing adjustment costs for carriers. While nothing can completely eliminate the stress and cost associated with catastrophes, policyholders can trust the plnar platform to get money in their hands faster and provide accurate information about their home for redesign and repair. By leveraging the plnar platform, carriers can become a caring, competent provider that makes policyholders feel respected and care for, all while lightening the burden on the bottom line.