UPC Insurance Partners with Plnar to Expedite Claim Processing by Integrating Plnar at First Notice of Loss

SAINT PETERSBURGH, FL and AUSTIN, TX, January 25, 2022 /EINPresswire.com/ — UPC Insurance, a personal and commercial lines insurance company with investments in emerging InsurTech innovations, today announced a new integration that speeds the entire claim process by enabling Plnar at the assignment stage – empowering adjusters to triage property claims without the need of an onsite inspection.

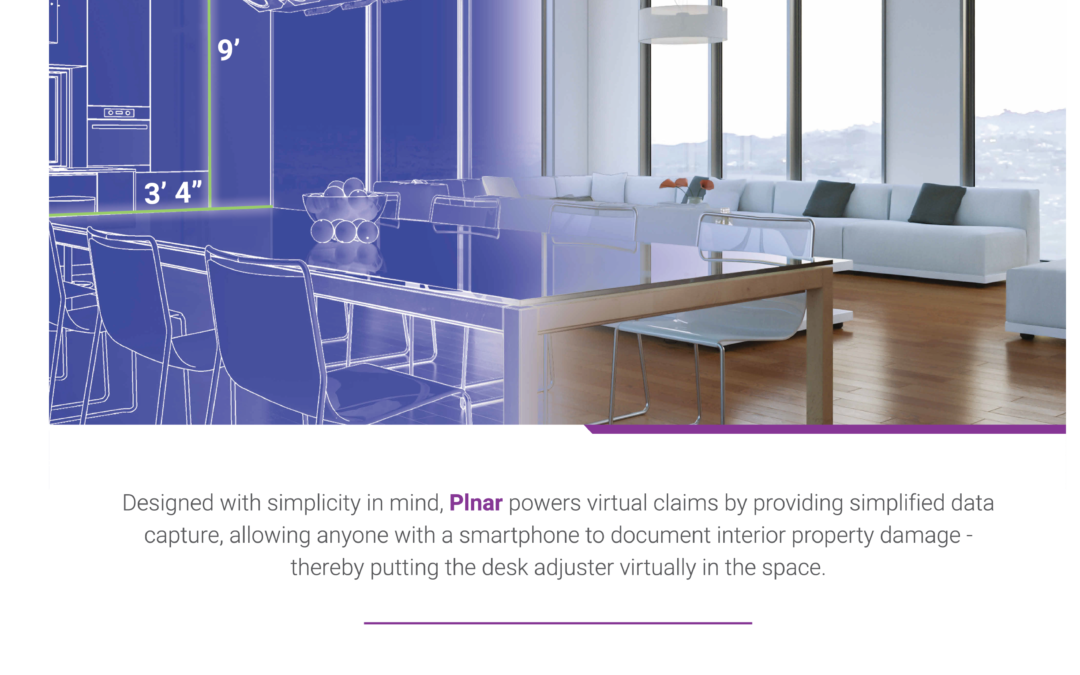

Designed with simplicity in mind, the Plnar Snap App provides policyholders with an easy-to-use solution to document their interior property damage in less than 2 minutes per room. Incorporating the Snap App into the claims adjudication workflow is another innovative technology that UPC Insurance has implemented within its automated platform.

“Plnar allows UPC Insurance to incorporate cutting-edge technologies while effectively managing risk and making policyholder self-service a reality” said Chris Griffith, Chief Information Officer and Chief Operating Officer at UPC Insurance. “UPC Insurance is continually evaluating opportunities to optimize technology and connectivity to deliver the superior customer experience that policyholders and agents expect.”

With the new Photo Upload feature, UPC Insurance policyholders will be able to upload interior and exterior photos to provide additional context of the claim, providing adjusters with everything needed to triage a claim before stepping foot on the loss site. Through this First Notice of Loss integration, adjusters instantly receive curated images organized by claim, relative location, and room; and quick-look room videos providing full context of the space. Within 1 business day, the adjuster will have access to full scope 3D models, 2D floorplans, measurable SmartPix photos, and a robust reporting suite.

“Plnar combines the latest in AI and smart phone technology to truly create a self-service claims solution,” said Andy Greff, CEO of Plnar. “Enabling Plnar at First Notice of Loss provides policyholders with the ability to document their damage directly after experiencing a loss, increasing the likelihood that claim information is complete.”

For more info or to see a demo, visit https://plnar.ai/request-demo/

***

ABOUT UPC Insurance

United Property and Casualty Insurance is a personal and commercial lines insurance company with investments in emerging InsurTech innovations.

ABOUT Plnar

Plnar is an InsurTech software provider transforming the insurance claims process by enabling contactless inspections for interior property claims for significantly better customer experiences, shorter cycle times and lower costs. Plnar’s patented technology platform gives desk adjusters the power to generate fully realized 2D and 3D models of interior spaces from digital photos and streamline the claims process for quicker, more efficient settlement. You can learn more about us by visiting plnar.ai.