Plnar and itel Partner to Integrate itel’s Cabinet Analysis Into Plnar’s Field Solution

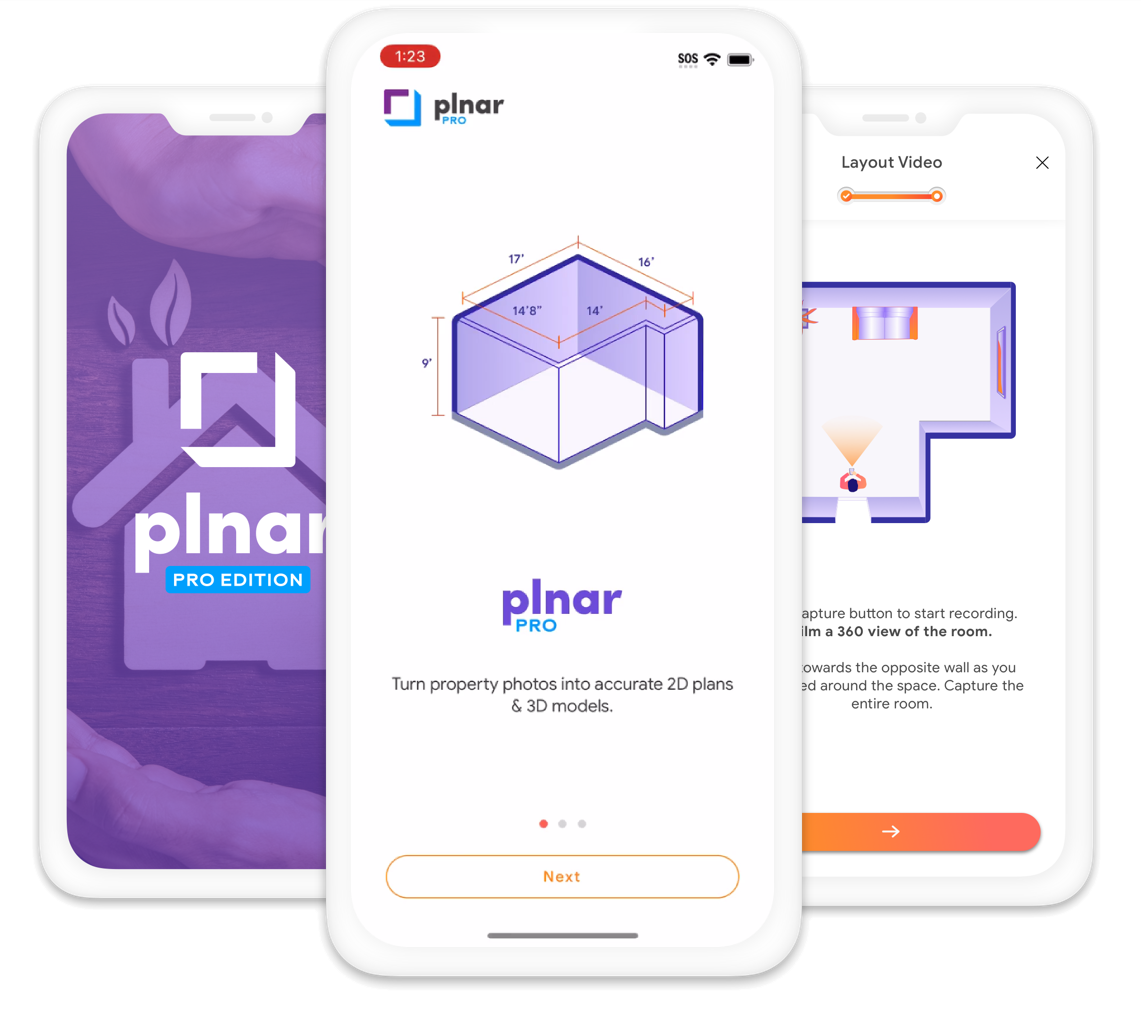

AUSTIN, TX, UNITED STATES, October 14, 2025 /EINPresswire.com/ — Plnar, the leader in documenting and digitizing every step in the property assessment lifecycle, and itel, a trusted provider of building materials analysis and pricing, announce a strategic partnership to integrate itel’s Cabinet Analysis directly into Plnar’s Pro App. This collaboration will enable field professionals to quickly document claims, generate 3D floorplans, and request itel Cabinet Analysis — all within a single, unified workflow.

Built for the property insurance, restoration, and inspection industries, the planned solution introduces a first-of-its-kind standardized, photo-based cabinetry analysis. It provides objective results that improve estimate accuracy, reduce claim cycle times, and reduce variability across field inspections. The companies will first focus on integrating cabinet grade determination from itel within the industry-leading Plnar Pro App. The app will collect high-quality imagery and feed directly into itel’s trusted Cabinet Analysis workflow. In the future, the companies plan to expand the integration into broader claims use cases.

As experienced adjusters leave the workforce and new professionals enter the industry, the increased reliance on third-party inspectors has introduced greater variability in photo documentation and measurement practices. This inconsistency has led to more re-inspections, extended processing times, and rising operational costs. This partnership addresses these pains, combining Plnar’s intelligent capture technology with itel’s lab-based verification to bring repeatability, accuracy, and confidence to cabinetry inspections at scale.

Executive Commentary on the Strategic Imperative

“For years, carriers have struggled with inconsistent cabinetry inspections — a critical gap impacting estimates, cycle times, and cost control,” said Andy Greff, CEO at Plnar. “By pairing Plnar’s intelligent capture technology with itel’s gold-standard analysis, we’re setting a new standard for data consistency that improves quality, reduces expenses, and accelerates claims for everyone involved.”

“We have long admired Plnar’s innovation in the industry. As we looked for the most effective ways to grow itel’s trusted analysis into more claims, partnering with Plnar was an obvious choice,” added Boogie Tate, SVP of Business Development at itel. “This is a win-win for carriers, claims professionals, and homeowners alike.”

About Plnar

Plnar’s patented AI-powered smartphone solution digitizes and standardizes every step of the property assessment lifecycle. By transforming simple smartphone photos into detailed spatial records—including precise floorplans—Plnar streamlines property documentation, reduces costs, and improves outcomes. The platform delivers a single, standardized solution for all claim documentation use cases, supporting field adjusters, large loss, flood adjusters, inspectors, homeowners, and water mitigation professionals.

Learn more at https://plnar.ai/cabinetry-analysis/

About itel

itel, a Nearmap company, is a data and technology company that is a source for certainty in the property insurance claims process. itel serves as an independent intermediary to insurers, adjusters, policyholders, and industry partners, providing objective data, expert analysis, and technology-enabled solutions that optimize the claims process. With itel, claims are settled accurately, fairly and with greater efficiency.

Learn more at www.itelinc.com.

Plnar Marketing

Plnar

+1 512-730-3650

marketing@plnar.ai