Intelligent Enterprises – The Importance For Insurance Companies To Make The Shift Now

The landscape of the insurance industry continues to evolve with emerging technologies, and that rate of progression is accelerating. Companies still hanging on to legacy practices are not only falling behind, they’re in danger of becoming completely obsolete.

Becoming a dynamic “intelligent enterprise” means setting a precedence for workforce empowerment AND customer experience via innovative digital solutions. In January of 2019, Accenture reported 90% of insurance executives now have a coherent, long-term plan for technology in place. More than 60% report that technology is already having a significant impact on their claims and underwriting processes. This transformation is paramount to increasing the strength and influence an organization has on the market. Not only do you have some of the largest organizations creating substantial competition, vying for top position, but this digital disruption created a slew of newcomers. These companies offer an abundance of innovative digital products and services proving to have tremendous influence.

For instance, take these three companies that are changing the very nature of insurance; and demonstrating what it means to provide empowerment through increased efficiency, agility, and transparency:

Tech startup Hippo cites itself as “a fresh approach to the home insurance market, which has seen little innovation in over half a century.” Hippo has a fixed focused on exemplary customer experience. It uses AI in a variety of ways, from gathering and utilizing agile personal and market data insights, to aerial imagery assessments for damage updates and/or predictions, all to provide an experience truly new and unique to the market.

Cystellar, a cloud-based big data analytics platform provides real time geospatial insights for live catastrophe and continued risk monitoring. Pulling data from satellite imagery, the (Internet of Things), and drone-based surveillance, the platform enables predictive analytics. They’ve made a huge impact with their primary data focus on helping insurers and their clients avoid damaging events, especially in the colossal agricultural and food sectors.

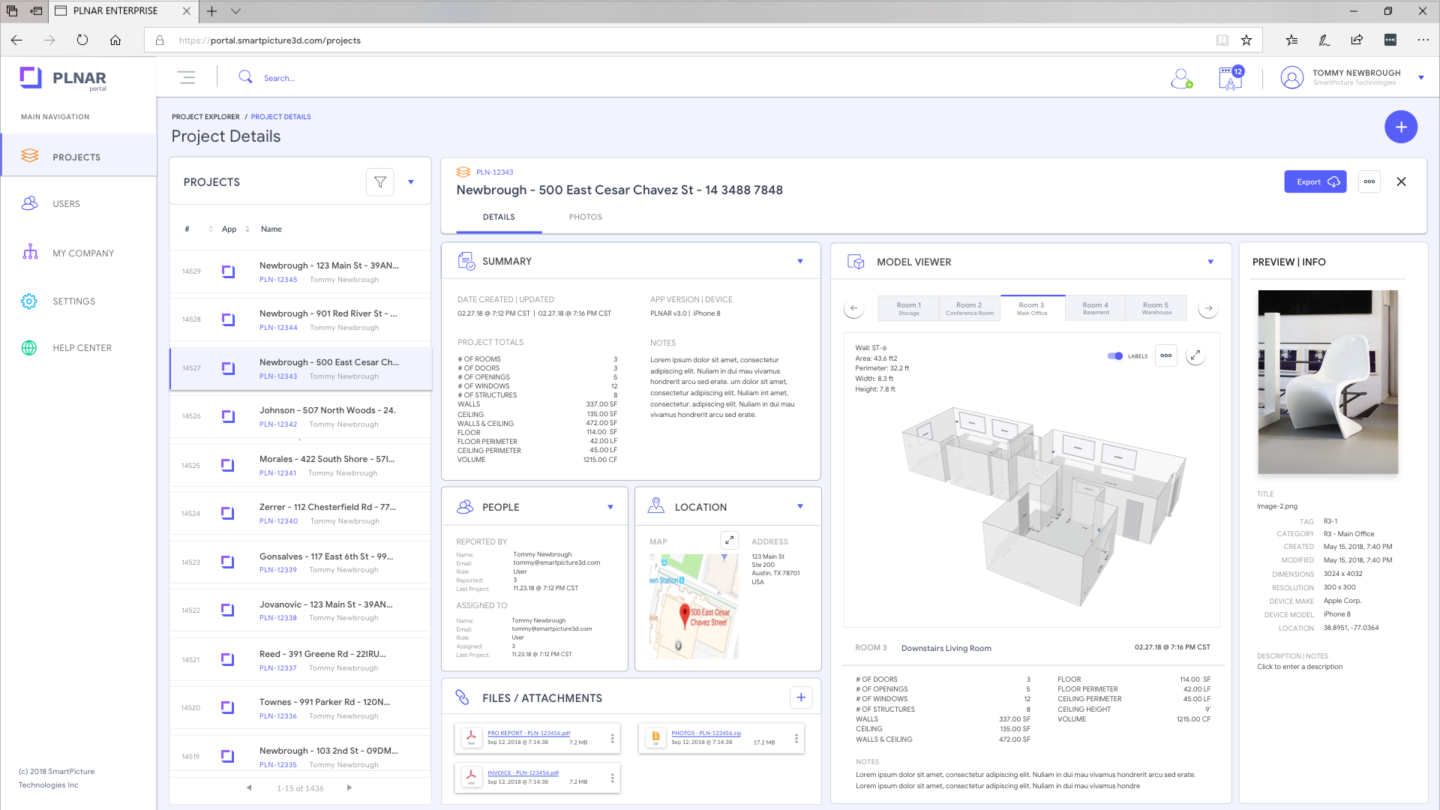

Finally, PLNAR offers the only interior virtual claims solution for comprehensive data collection designed for insurance. It utilizes an Augmented Reality app and cloud-based reporting for Claims Adjusters to fully scope a claim in less than half the time. Measurements, photos, annotations (scope notes), and 2D & 3D floor plan models are packaged in a customized report in just minutes. With real time reporting to carriers, customer satisfaction is improved by offering a higher level of transparency and service.

“The operational efficiencies you can capture by applying technology to the middle and back office are a huge, real-time measurable benefit.” – Greg Baxter, MetLife

The key staples of disruptive products and services are agility, proactivity, responsibility, transparency, and relevancy. So how does a legacy insurance organization begin to pivot? It starts with a rapid re-prioritization of organizational focus and assets, a deliberate evaluation of products and services to implement, and a willingness to collaborate with advanced technology business partners.

In my next blog post, I’ll discuss the impact that AR/VR is having on the insurance industry. For further information on the previously mentioned disruptors, click the links below.

Hippo www.myhippo.com | Cystellar www.cystellar.com | PLNAR www.plnar.ai